unemployment tax credit check

The federal unemployment tax rate was reduced from 66 to 42 as a result of the Act. Check Unemployment Benefits Online.

Taxpayers Can File Amended Relief For Unemployment Benefit Tax Relief

As a result of this reduction Floridas reemployment tax rate increased.

. The amount people will actually receive will vary and not everyone is. You have a net increase in full-time employee equivalents you receive a partial amount of the tentative credit. Most employers qualify for a tax credit of 54 0054.

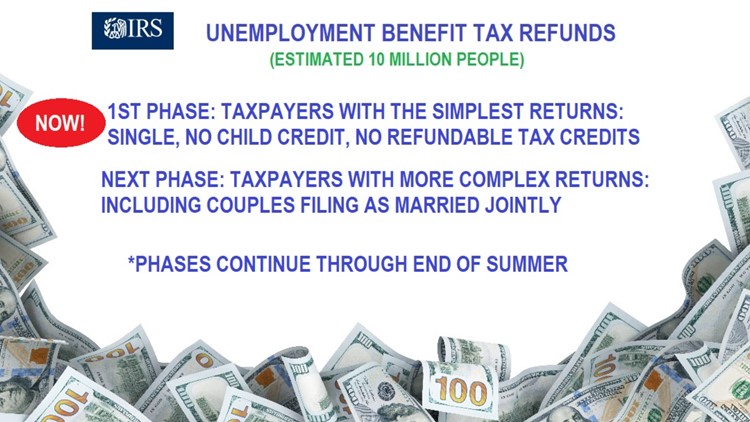

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if. The 10200 tax break is the amount of income exclusion for single filers not. You may also see TAX.

The IRS will have to process and review tax returns and taxes paid on unemployment benefits to do this. If not you need to file an amended return to report it. View Refund Demand Status.

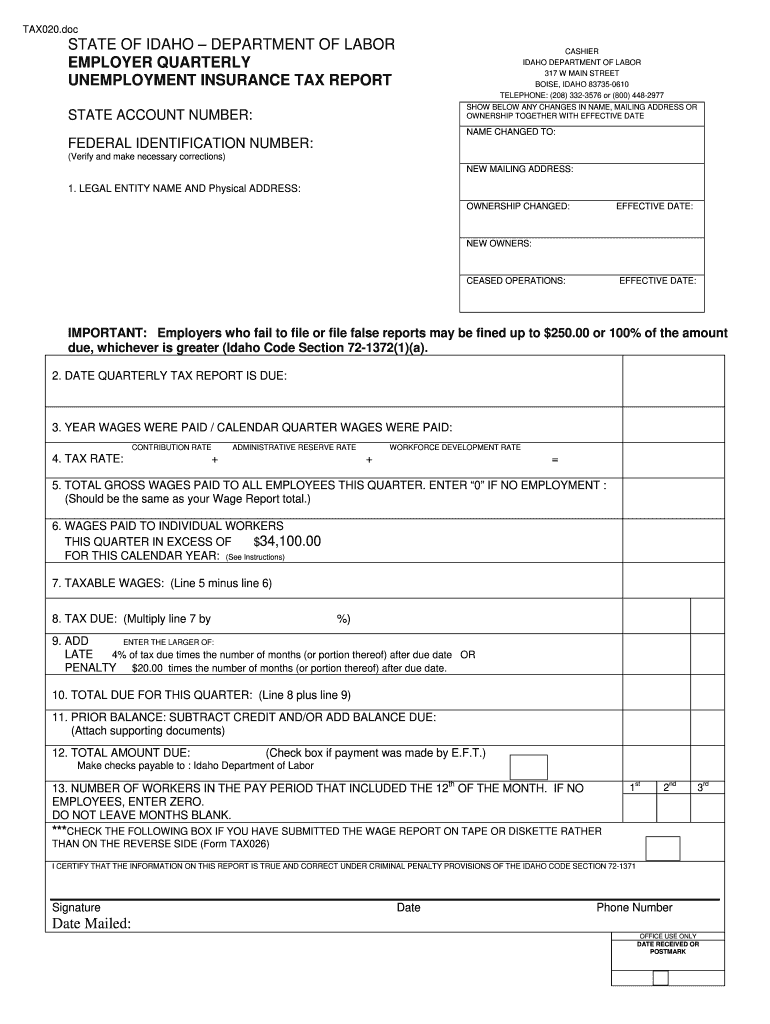

Find Federal Unemployment Tax Act FUTA tax filing and reporting information applicable to US. Premium federal filing is 100 free with no upgrades for premium taxes. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

Go to IRSgovEITC to see. The FUTA tax rate is 6 006. Check to determine whether you qualify for the Earned Income Tax Credit if you have a low to moderate income.

The agency is juggling the tax return backlog delayed stimulus checks and child tax credit payments. If you are still eligible. And for nonresident aliens.

Keep in mind though that American households with 150000 or more in earned income are ineligible for the new benefits. 6300 6300 x 100 Example 2. The procedure for requesting the third stimulus check that has not arrived to you Posted on by The IRS has already processed most of the 1400 third round payments.

For example if you are single with an adjusted gross income AGI of 70000 and you received 15000 of unemployment benefits during the 2020 tax year you would enter. The first 10200 wont be taxable. In any case dont let money slip through your fingers.

This means up to 10200 of unemployment compensation is not taxable on your 2020 tax return. This lowers the FUTA tax rate to 06 0006. Some employers might not receive the.

The IRS has stated that the first of these refund. In Box 1 you will see the total. This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits.

Go to My Account and click on RefundDemand. And you may get back any withholding taken out. Citizens employed outside the US.

Did you include the unemployment on your tax return. If you are married each spouse receiving unemployment compensation. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. The Opportunity Program will be funded with tax-exempt mortgage revenue bonds. Visit your states Department of Labor homepage and check to see if there is an online inquiry form you can use to check your.

In Box 4 you will see the amount of federal income tax that was withheld. Even though the chances of speaking with someone are slim you can still try.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Fourth Stimulus Check News Summary Friday 14 May 2021 As Usa

Did You Get Unemployment In 2020 You Could See A Tax Refund Soon Wfmynews2 Com

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News

1099 G Unemployment Compensation 1099g

Are You Still Waiting For The Unemployment Tax Break Worth 10 200 Here S How To Check For A Refund Fingerlakes1 Com

Here S How The 10 200 Unemployment Tax Break Works

Irs Sending Unemployment Tax Refund Checks Youtube

Taxes On Unemployment Benefits A State By State Guide Kiplinger

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring Tax Policy Center

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wkrc

Filing Your Taxes Soon Here S How Covid 19 Stimulus Could Affect What You Owe

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Year End Tax Information Applicants Unemployment Insurance Minnesota